21+ Mortgage rates rising

A good rule of thumb is six months of mortgagetax and insurance for loans under 750000 and 12 months for jumbo loans says Melissa Cohn an executive mortgage banker at Connecticut-based. Borrowers will now find the typical two-year fixed mortgage will have an interest rate of 424 the highest since 2013 and a far cry from average 234 seen in December.

Sad But True Rising House Prices Remax Sound Properties Facebook

I was planning to move before the seven years was up but now Im not sure because other home prices have gone so high.

. Todays mortgage rates are mixed across all loan categories. Mortgage rates came back down slightly this week after the key 30-year loan rate jumped nearly a quarter point last week. Mortgage buyer Freddie Mac.

August 15 2022 330 PM. There are many different kinds of mortgages that homeowners can decide on which will have varying interest rates and monthly payments. View current daily average mortgage rates for fixed and adjustable rate loans.

A total of 21 buyers at a Cheung Sha Wan project failed to complete transactions they agreed to in 2020 amid falling prices and rising mortgage rates. How homebuyers of color are disproportionately impacted by rising mortgage rates. How To Negotiate Your Closing Costs.

The factors leading to this decline according to the Greater Lehigh Valley Realtors are the rising mortgage rates coupled with sky high sales prices. Mortgage rates rose to their highest level in two months this week providing no relief for a slumping housing market. WASHINGTON AP Average long-term US.

Historically the 30-year mortgage rate reached upwards of 186 in 1981 and. That in turn stifles affordability and. Borrowers who are planning on applying for a 30-year fixed-rate mortgage will find rates averaging 6667 0039 percentage points higher than yesterday.

Living standards of working-age. The 30 Year Mortgage Rate is the fixed interest rate that US home-buyers would pay if they were to take out a loan lasting 30 years. The average rate for a 30-year mortgage has topped 6 for the first time since 2008 hitting 602 this week.

Not only are mortgage rates rising but the dispersion of rates has increased suggesting that borrowers can meaningfully benefit from shopping around for a better rate. I have a seven year adjustable mortgage thats two years in. Its not surprising that mortgage rates are climbing Danielle Hale chief.

Average long-term US. Rising mortgage rates and lingering inflation are forcing many Americans to put plans to buy a home on hold. The Best 15-Year Mortgage Rates for 2022.

Mortgage rates rising again just as the number of new listings of. Moneys average mortgage rates for September 13 2022. Learn more about mortgage rates and how we can help you reach your home ownership goal.

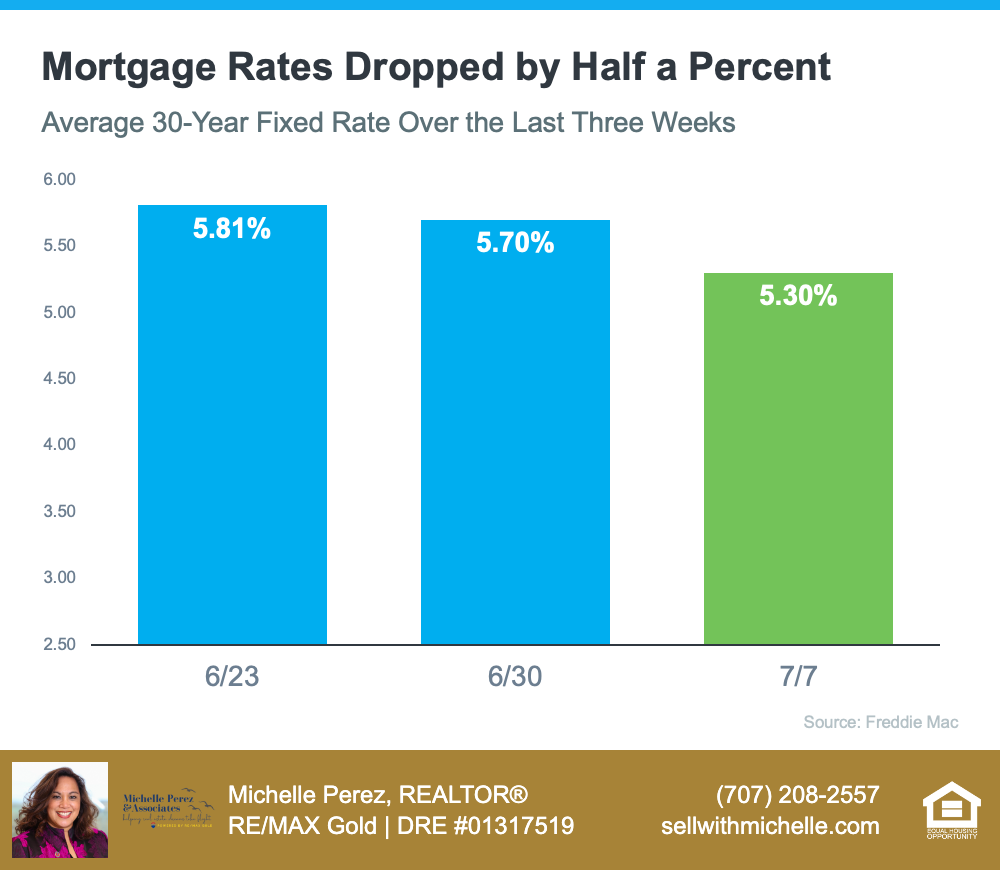

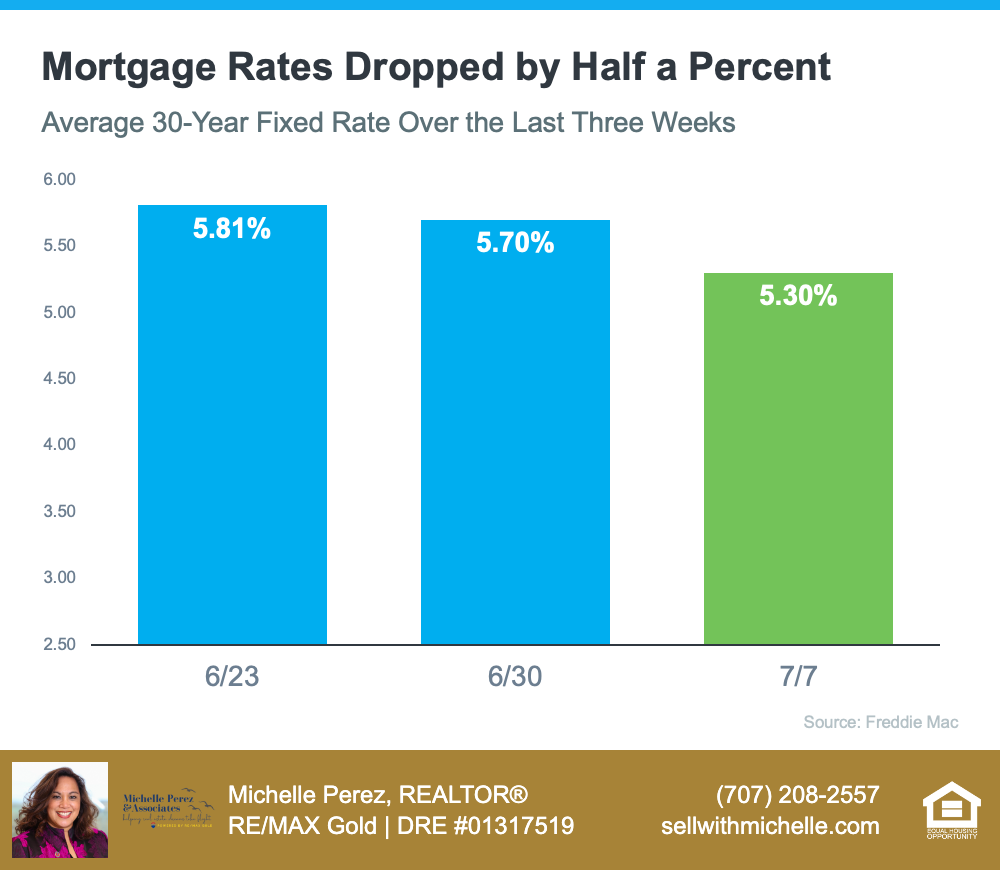

Monthly Average Commitment Rate And Points On 30-Year Fixed-Rate Mortgages Since 1971. While the rate remains lower than the 581 registered in June its still 2 percentage points higher than the start of the year. That is pushing up rent prices for others.

Borrowers with lower credit scores will generally be offered higher rates. Mortgage rates rose again as markets continue to manage the prospect of more aggressive monetary policy due to elevated inflation. Increases in mortgage interest rates push up the numbers paying over 20 of their income as a mortgage to 14 with a 125ppt rise and to 17 if there is a 250ppt rise.

What are the implications of rising interest rates for household budgets and who could see mortgage repayments reach a high. Mortgage rates have been rising and are likely to remain elevated this month as investors await the Federal Reserves next rate hike decision on September 21. Our research indicates that borrowers could save an average.

The Best 20-Year Mortgage Rates for 2022. 25 Freddie Mac says. Amount of new homes getting put on the market was down 15 percent year-over-year in the four-week period ending August 21.

How to Lower Refinance Closing Costs. Mortgage rates jumped back above 5 after briefly and barely falling below that level last week. Mortgage buyer Freddie Mac reported Thursday that the 30-year rate rose to 566 from 555 last week.

As potential home buyers respond to these rising costs real estate. Homebuilder confidence declines for eighth straight month amid rising mortgage rates. The rate on the 30-year fixed mortgage increased to 522 from 499 the week prior according to Freddie Mac.

A view of The Vertex in Cheung Sha Wan. Thats up 42 basis points from last week. 2 days agoMeanwhile in line with Bank of England rate rises the average two-year fixed rates and five-year fixed rates have increased for the 11 th consecutive month.

Mortgage rates rise amid signs of waning demand for homes The 30-year fixed-rate mortgage averaged 555 as of Aug. Mortgage rates climbed above 5 again after dipping below that threshold for the first time in months a week earlier.

News Michelle Perez Realtor Re Max Gold

Where To Find Value Add Investing Opportunities American Association Of Private Lenders

Where To Find Value Add Investing Opportunities American Association Of Private Lenders

Noote Partners Compass Real Estate Home Facebook

News Michelle Perez Realtor Re Max Gold

News Michelle Perez Realtor Re Max Gold

Nk Mortgage Solutions Facebook

Xmnm56py84vd2m

News Michelle Perez Realtor Re Max Gold

Vrl Uelufir Bm

A Helpful Chart How Inflation Changes Mortgage Rates Mortgage Rates Mortgage Real Estate Infographic

News Michelle Perez Realtor Re Max Gold

Where To Find Value Add Investing Opportunities American Association Of Private Lenders

What You Should Do Before Interest Rates Rise Mortgage Interest Rates Mortgage Interest Interest Rate Rise

Interest Rates Over Time Infographic Interest Rates Mortgage Rates Mortgage Interest Rates

How Does Every Interest Rate Hike Affect Your Income Qu Real Estate Information Interest Rates Real Estate Buying

News Michelle Perez Realtor Re Max Gold